Depreciation rules |

Depreciation is calculated during end-of-month processing (see the System Mgmt -> End of Period screen) for the following month (not the month just ending). In order for the system to select an equipment unit for depreciation calculation, the unit must satisfy the equipment monthly cost charging rules and must have a value other than NONE in the Depreciation method field on the Ownership and Depreciation tab of the Data -> Equipment Units -> Fleet Equipment screen.

For each unit that meets these requirements, depreciation is computed in accordance with the depreciation method specified for the unit.

There are five (5) Depreciation methods used by the Application:

British Declining

The Application computes the British Declining depreciation method with the following steps:

Step 1. Calculate the Depreciation Base (capitalized value).

Step 2. Calculate the Depreciation Remaining by subtracting the Depreciation Previously Taken from the Depreciation Base.

Step 3. Set the following, dependent on the Depreciation Months Remaining:

-

Less than or equal to 0: Sets the current month Depreciation to zero.

-

More than 0: Calculates the current declining balance (Depreciation Remaining).

Step 4. Calculate y = 1 / depreciation life months.

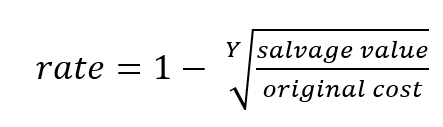

Step 5. Calculate the depreciation rate:

Step 6. Calculate the current month depreciation (current declining balance x depreciation rate).

Step 7. If depreciation for the current month is more than the depreciation remaining, FASuite sets the following:

-

Depreciation for the current month to the depreciation remaining

-

Depreciation months remaining to 0

Step 8. Insert Recurring Charges record to the EOM_TRANSACTIONS table on the End of Period screen with Charge type set to DEPRECIATION.

Canadian Declining

The Application computes this method by adding a row with a Depreciation Cost of zero (0) to the EOM_TRANSACTIONS table on the End of Period screen.

Daily Straight Line

Daily Straight Line Depreciation depreciates the value of an equipment unit by the same percentage each day.

To set up this method the following data must be set in order to calculate the daily depreciation rate:

- Date and time In Service

- Original cost

- Depreciation Life Months

It is not recommended to change depreciation method from DAILY STRAIGHT LINE to another method once depreciation has been started for the asset.

The Application computes the Daily Straight Line depreciation method with the following steps:

Step 1. Calculate the daily depreciation rate. This rate comes from the Asset which is calculated when the asset is inserted or updated.

- Daily depreciation rate = (Original Cost – Salvage value + Capitalized Value) / number of days of life of asset.

- Number of days of life of asset is calculated from the in service date + number of life months as a days value. This will cover the case of leap years.

Step 2. Calculate the depreciation base (original cost + capitalized value - salvage value).

Step 3. Calculate the depreciation remaining (depreciation base - depreciation previously taken). Depreciation previously taken is the summation of depreciation for the asset via Historical Costs (EQ_COST_DATA.deprec_cost).

Step 4. Set the following, dependent on the depreciation remaining:

-

Monthly depreciation = Daily depreciation rate * Days in Month

-

If the remaining depreciation is less than monthly depreciation: Set the depreciation for the current month to the remaining amount and set months remaining to 1.

-

If the months remaining equals 1 and the remaining depreciation is greater than the monthly depreciation: Set the depreciation for the current month to the remaining amount.

-

If the remaining depreciation is equal to or greater than monthly depreciation: Uses the calculated monthly depreciation.

Step 5. Subtract 1 from the number of depreciation months remaining.

Step 6. Insert Recurring Charges record to the EOM_TRANSACTIONS table on the End of Period screen with Charge type set to DEPRECIATION.

Straight Line

Straight line depreciation depreciates the value of an equipment unit by the same percentage each month.

The Application computes the Straight Line depreciation method with the following steps:

Step 1. Calculate the depreciation base (original cost + capitalized value - salvage value). The unit’s original cost and capitalized value are specified on the Acquisition tab on the Data -> Equipment Units -> Fleet Equipment screen.

Step 2. Calculate the depreciation remaining (depreciation base - depreciation previously taken). Depreciation previously taken is the summation of depreciation for the asset via Historical Costs.

Step 3. Set the following, dependent on the depreciation remaining:

-

Monthly depreciation is depreciation base / depreciation life months.

-

If the remaining depreciation is less than monthly depreciation:

Set the depreciation for the current month to the remaining amount and set months remaining to 1.

Step 4. Subtract 1 from the number of depreciation months remaining.

If depreciation for the current month is more than the depreciation remaining, the following are set:

-

Depreciation for the current month to the depreciation remaining

-

Depreciation months remaining to 0

Step 5. Insert Recurring Charges record to the EOM_TRANSACTIONS table on the End of Period screen with Charge type set to DEPRECIATION.

None

The Application computes this method by adding nothing to the EOM_TRANSACTIONS table on the End of Period screen.